SOURCE : SMITHERS PIRA - 2016

An insight into the luxury packaging market that continues to grow globally, driven by exciting trends - the surge of personalised packaging, attention to sustainability issues, economic and demographic drivers.

Data from the Smithers Pira report The Future of Global Packaging to 2020 estimates a total world market for all packaging in 2015 worth $839 billion. This will grow steadily at a rate of 3.3% year-on-year through to the end of the decade; with the market will be worth nearly $1 trillion in 2020.

Luxury packaging is a lucrative, fast developing segment of this; Smithers Pira values it at $14.8 billion in 2015. It relative share belies its importance to the broader industry however. It is a segment where higher unit costs and the willingness of brands to invest in designs that directly enhance their products making it a cockpit for the entry and perfection of novel technologies.

LUXURY IN VARIETY

Luxury packaging designers are increasingly gaining access to high-quality materials, finishes, decoration, innovative shapes, and caps and closures that enhance the consumer experience of the product. In its recent report The Future of Luxury Packaging to 2019 Smithers Pira identifies six key end-use applications:

- Confectionery

- Cosmetics & fragrances

- Gourmet food & drinks

- Premium alcoholic drinks – top-end spirits, wines and champagnes

- Tobacco

- Watches & jewellery

Across these, cosmetics and fragrances is the largest, accounting for a projected 43.3% share of luxury packaging market by value in 2014. This is followed by premium alcoholic drinks and tobacco, which have market shares of 21.9% and 16.5% respectively. In terms of volume, premium alcoholic drinks accounts for the largest share at 46.0%, followed by cosmetics & fragrances, which has a share of 31.0%.

Across the luxury markets under review, cosmetics & fragrances and watches & jewellery are forecast to be the fastest growing sectors for value and volume over the next 4 years. This growth in cosmetics & fragrances and watches & jewellery is driven by increased demand in emerging markets. Consumption of tobacco is set to grow only slowly by comparison over the next five years, with a decline in the developed regions of Western Europe and North America. Profits of luxury packaging suppliers in this area will also be seriously damaged if regulatory mandated plain tobacco packs – currently active in Australia and planned for the UIK – spread.

All of these applications are potentially profitable markets for packaging manufacturers. This is because luxury packaging margins are typically higher than in mass-market packaging due to the greater perception of value it can add to the product. This is also reflected in a willingness for more investment in design and development work and justifies a larger outlay on materials and converting processes.

As the market expands, luxury applications will outstrip mean expansion in the packaging industry, growing at 4.4% in value terms year-on-year through to 2019 – culminating in a market Smithers Pira estimates at $17.6 billion in that year. Growth will be highest in Asia and the currently modest market of Latin America. The more mature regions of Western Europe and North America will see growth that, while still healthy, is below the global average.

The volume of luxury packaging consumed will increase at 3.1% annually across the same period.

GLOBAL BRANDS

In the 21st century globalised economy, ongoing industry consolidation means there is a smaller number of worldwide luxury houses that own multiple brands across different high-value markets. Examples of such houses are Moët Hennessy Louis Vuitton (LVMH) – the most valuable luxury goods group in the world; Richemont, PPR; and Kering.

Such companies are keen to maintain, and where possible burnish, brand identities on a global scale. They are investing to evolve several key technologies that will help shape and bolster the luxury packaging market over the next five years, including:

- Anti-counterfeiting and brand protection

- Digital printing

- Enhanced embellishment and tactile effects

- Connection to the online world via smart devices and Big Data stores.

In addition to these technology developments, there are a number of other factors impacting the direction towards which luxury packaging is developing, including:

- Active packaging that can affect the goods within is increasingly being used for luxury products, with for example, isothermal sleeves for champagne to keep the drink cool;

- Luxury experience packaging where increased physical engagement with the branded pack enriches the consumer’s overall experience. This encompasses designs for novel opening and unwrapping mechanisms; infusing paper and packaging material with long-lasting fragrances; and fixtures, for example magnetic closures for colour cosmetics compact cases so that consumers are able to hear a sound confirming that the product has closed correctly;

- Personalised packaging, where a packaging product is embellished to make it unique and personal to the consumer – a trend that is most prevalent in gift-giving and driven by the technical capability of inkjet printers;

- Sustainability is a megatrend across packaging. Luxury brands too are aware that a greener profile is a worthwhile commitment for products like confectionary and cosmetics.

SUBSTRATES

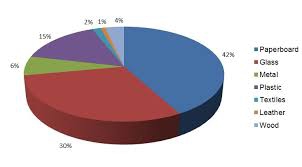

The main materials used in luxury packaging are paperboard, glass, metal, plastic, textiles, leather and wood. Paperboard is the most popular material used in luxury packaging, accounting for a projected 41.9% share of luxury packaging market value in 2014. The second most used material in value terms is glass, followed by plastic, with market shares of 30.1% and 15.4% respectively.

Source : Smithers Pira

In terms of market volume, glass accounts for the largest share at 58.3%, followed by paperboard, which has a share of 25.9%. This discrepancy can be explained by the relatively lower cost of glass per tonne, compared to both luxury paperboard and plastic, as well as the higher unit weight and density of glass – particularly in the case of premium alcoholic drinks.

Across luxury packaging materials, plastic and glass are forecast to show the highest growth rates in value terms through to 2019. Plastic is also set to be the fastest growing material in terms of volume.

Demand for both glass and plastic is being driven by the recovery and stronger growth evident in the main luxury markets, particularly cosmetics and fragrances. Glass on the whole is losing share in packaging, but is proving much more resilient and hard to replace in luxury applications. Here it remains popular with brand owners and consumers, due in part to its strong sustainability associations, but more importantly for its high-quality appearance. Rising demand for plastic packaging meanwhile is being driven by its lower cost and lighter weight.

MARKET LANDSCAPE

The mass-market packaging industry is increasingly consolidated – especially in older material formats like glass and metal – but less so for newer rigid and flexible polymer types. The luxury packaging supply industry is also diverse – consisting of a large number of businesses with a broad range of sizes, scopes and product offerings.

There are a number of multi-material companies that have a particular speciality in luxury packaging; for example, the Verpack Group is a leading European manufacturer, specialising in luxury packaging made from both cardboard and plastic. There are also a number of large international packaging groups that specialise in one particular material and supply to the luxury market – for example, Mayr-Melnhof is one of the leading paperboard manufacturers, Ardagh Glass is a top glass manufacturer and Crown Specialty Packaging is a prominent metal packaging supplier.

BRAND PROTECTION

Counterfeiting that leads to lost sales and damaged brand perception is among the top concerns for luxury brands. This is a problem to which luxury pack designs can provide an answer – principally because high-grade materials and embellishments are much harder for counterfeiters to copy convincingly – giving an indication to consumer before they buy.

This opportunity is now coalescing around a number of key trends like enhanced decorative holograms and covert taggants and electronic platforms, where buyer can verify products themselves via smart device. The basic level for this is via QR codes. Such visual signs have a major drawback however in that their block monotone graphics are likely to seriously impinge on the overall appearance of the pack.

Systems that rely on radio-frequency identification (RFID) and increasingly Near-Field Communication (NFC) protocols have the advantage of being discrete. Furthermore the higher margins in luxury packaging mean that cost considerations that inhibit roll-out in mass applications are less of a barrier.

NFC, QR and RFID platforms have the added benefit that they can also allow the consumer and brand to interact – forging a deeper, more enduring relationship. For example, once a consumer has confirmed the authenticity of a purchased product using an internet connection to a secure online database, the same medium can be used to offer vouchers for repeat or complimentary purchases.

[TO READ THE COMPLETE ARTICLE]