BAROMETER PROMISE – EXANE BNP : LUXURY IN THE USA 2016

[ACCEDER A LA VERSION FRANCAISE DU COMMUNIQUE DE PRESSE]

Promise Consulting Inc., an acknowledged consulting and market research firm, joins forces with Exane BNP, a key actor in the European financial market and a specialist in research and analyses for the European, Asian and American luxury sector, to publish the 3nd wave of the 2016 Promise – Exane BNP Barometer on "Exclusivity & Desirability of top luxury brands in the USA".

This barometer classifies the 22 most known, purchased, exclusive and desired brands in the US in the universe of personal luxury goods (fashion). This year’s barometer was conducted amongst the wealthiest American women from the Industry Interviews ranking, Exane Paribas Estimates & Analysis (2015), who were interrogated on the categories ready-to-wear, handbags, shoes and accessories.

With its macro vision of the American luxury market, the barometer establishes basically a section on the brands’ awareness, purchase and the brand image, with a focus on the notions of exclusivity and desirability.

[DOWNLOAD HERE THE SLIDES IN PDF FORMAT]

[DOWNLOAD HERE THE SLIDES IN PDF FORMAT]

EXPERT OPINION

« The first two waves of the “Front Row” Barometer confirmed already the existence of an implicit hierarchy among top luxury brands and the others. Now, after France and China, the Barometer measured in its third year the exclusivity and desirability of top luxury brands amongst the wealthiest women in the US in the sector of women’s fashion (ready-to-wear, bags, shoes and leather accessories). The results outline that the Americans have a very special vision of luxury brands. Considering that Ralph Lauren occupying the first place in terms of penetration, followed by Chanel and Gucci, is not a surprise, the performance of Vera Wang is definitely noteworthy and needs to be emphasized: Indeed, the brand of the American fashion designer with Chinese roots, is ranked on 4th’s position, demonstrating therefore that the brand’s reputation now exceeds the world of wedding dresses, on which the designer brand from Now York initially based its fame, awareness and reputation.

Prada, Versace, Louis Vuitton and Gucci occupy the top four ranks on exclusivity, which is proof enough - if proof was even needed - that the Italian fashion brands highly attract the US customers, while only Louis Vuitton manages to position itself on #3. Should we interpret this as the revenge of designer brands and family businesses as opposed to large international luxury groups? This special attachment to the founder’s personality is also reflected in the performance of Ralph Lauren, who ranks second in desirability despite not claiming to exclusivity. In order to qualify our statement, we need however to recognize the resilience of Louis Vuitton (3rd in exclusivity and 1st in desirability). The flagship brand of LVMH confirms and even strengthens its position on these two criteria that the brand had already obtained in our last two barometers, China and France. Therefore, Mr. Bernard Arnaud’s objective to make "Louis Vuitton, the most desirable brand in the world" does not seem out of reach. While occupying an excellent 3rd place in desirability (behind Louis Vuitton and Ralph Lauren), Chanel receives in terms of exclusivity a surprising 10th place from the wealthiest female customers in the USA, which is in particular due to the perception gap between the brand’s younger and older clients. The brand reveals itself to be less consensual in the US than elsewhere on this criterion. »

Philippe JOURDAN,

Associate of Promise Consulting, University professor and member of the American Marketing Association (AMA)

METHODOLOGY

The PROMISE – EXANE BNP "EXCLUSIVITY AND DESIRABILITY" Barometer has an international vocation and is renewed and published every year in several countries and on several luxury product in the universe of fashion and cosmetics (« soft luxury »). Both measured criteria – DESIRABILITY and EXCLUSIVITY – are based on a general model consisting of 24 key indicators which measure a brand’s performance from a customer’s point of view (« customer-based brand value »). This model, - called Monitoring Brand Assets®- is marketed by Promise Consulting for its numerous clients in the sector of Fashion, Beauty and Distribution, who use the methodology in order to establish their marketing plans and measure their brand’s performance and return on investment (ROI).

> Collection method: Online Access Panel

> Period of data collection : June 2016

> Country : USA

> Univers : Luxury (prêt-à-porter, handbags, shoes, accessories, etc.)

> Sample : 750 adult women (25-54 years old) with a monthly household income of + 12 500$

> Theme : BAROMETER PROMISE - EXANE BNP : LUXURY IN THE USA 2016

> List : 22 evaluated brands

> Measured indicators : Awareness, Penetration, Brand Image, Exclusivity and Desirability

DESIRABILITY

The brand desirability index is based on the brands which the respondents recognized among the presented ones. The desirability is measured according to the Likert scale with 7 points (and converted afterwards into an index), among the respondents who consider the brand as "ideal / close to their ideal" and those who think the brand is " not ideal / far from their ideal." It is then presented as the percentage of respondents who opted for the top 2 of the Likert scale, the notes 6 or 7. This scale was tested on its robustness, validity and reliability in an international and multicultural context.

EXCLUSIVITY

The brand exclusivity Index is constructed thanks to the brands which the respondents recognized among the presented ones. The exclusivity is measured according to a Likert scale with 5 points, increasing from “more accessible” to “more exclusive”. Such as for the desirability, the exclusivity score is equally converted into an index based on the % of respondents, who attributed the notes 5 or 4. This scale was tested on its robustness, validity and reliability in an international and multicultural context.

USA : 1ST LUXURY GOODS MARKET DESPITE ITS LOW GROWTH AT CONSTANT EXCHANGE RATES

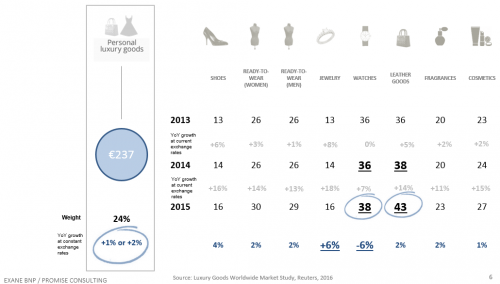

A GLOBAL MARKET VALUE OF €237 BN ON PERSONAL LUXURY GOODS

The global market for luxury consumer goods accounts for € 237 billion and represents therefore the second most important segment after luxury cars (€ 379 billion) and hotels (€ 165 billion), which is equivalent to nearly one quarter (24%) of the amount spent in all categories of the luxury sector together. (Source: Luxury Goods Worldwide Market Study, Bain, 2016).

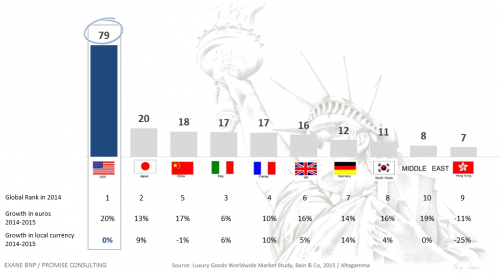

USA: 1ST GLOBAL MARKET

Considering the entire market of luxury consumer goods, the USA is ranked on the first place with almost 79 billion euros purchase (2014). The USA imposes itself on the other countries and is therefore far ahead of Japan (€ 20 billion), China (€ 18 billion), Italy and France (€ 17 billion). If growth remains important, the latter was since 2014 essentially due to exchange rate differentials between the dollar and the euro, wherefore the growth at constant exchange rates is zero.

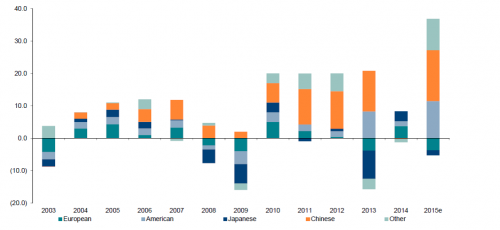

USA: 2ND MOST IMPORTANT CONTRIBUTER TO THE MARKET GROWTH

With their purchases on luxury consumer goods, US citizens have contributed between 2012 and 2015 to nearly a third of the growth in this market, wherefore the USA can be considered as the market growth’s second contributor, right after China. (Source: Bain & Co, Altagamma, Exane BNP Paribas analyses & estimates).

DIGITAL AND LUXURY IN THE USA, A CONTRADICTION? NOT AT ALL!

Today it is a fact that the luxury market exists beyond the boundaries of physical point of sales. For example, YOOX NET- A- PORTER GROUP is the perfect illustration of this trend. Thus, 49 % of the respondents claim having already bought luxury consumer goods online, either several times or at least once, while 28 % are planning on doing so very soon. (Source : Promise Consulting / Exane BNP).

A MATCH BETWEEN ITALIAN AND FRENCH BRANDS UNTER THE ARBITRATION OF RALPH LAUREN

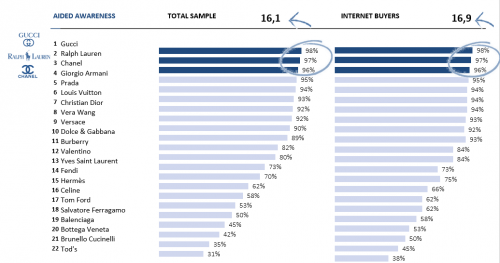

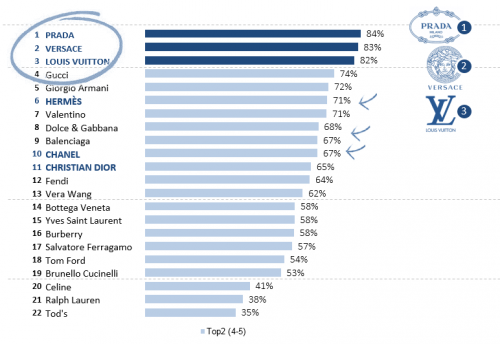

AIDED AWARENESS: « FRATELLI D'ITALIA »

The graphic on the left visualizes that 5 Italian brands are positioned among the top 10 ranking in terms of aided awareness, while only 3 French brands managed to do so. Gucci is clearly the winner in this category and benefits from an excellent media coverage accompanied by the faultless direction of the young Alessandro Michele.

Although, during the financial year 2015-2016, the sales of Ralph Lauren fell by almost 3%, to 6.3 billion euros, the brand does not suffer from notoriety issues. In terms of notoriety the brand occupies position No. 2 and remains an industry benchmark in its country of origin.

In fact, wasn’t it the US Olympic team which was dressed in blue-white-red by Ralph Lauren at the opening and closing ceremonies of the Olympics in Rio? The arrival of Ralph Lauren’s new executive director Stefan Larsson, former head of Old Navy, will definitely encourage new strategies and marketing approaches for the iconic American brand. Chanel is ranked on the third position of the podium with the brand’s new muse Lily-Rose Depp (as it was already her mother) and saves therefore the honor of the French luxury houses. Finally, we note the emergence of Vera Wang on the 8th position in this ranking, who is well known as a specialist of wedding dresses, including the one of Sex and the City-star Carrie Bradshaw. In this ranking Internet purchases do not disrupt brand awareness, but confirms rather that online shoppers know more brands and that luxury becomes more attracted to digital media which involves the customers, making them even sharper concerning their knowledge of the brands in this sector.

PENETRATION AND AIDED AWARENESS STAND INDEED IN RELATION TO EACH OTHER

With a cumulative penetration of 63%, Ralph Lauren takes the lead on its national market. Far behind, with 43%, Chanel monopolizes the second position followed by Gucci with 41%. In the universe of women’s luxury fashion, the most well-known brands are consequently also the most purchased ones (the podium remains the same, only the order is reversed here).

Finally, Vera Wang has wind in her sails and occupies with a cumulative penetration of 38% the bottom of the podium: the position of the New York designer with Chinese origin illustrates that the brand’s popularity goes far beyond the world of wedding dress, on which the designer initially established her image and reputation.

EXCLUSIVITY : ITALIAN DESIGNERS ADHEAD OF THE FRENCH HAUTE COUTURE HOUSES

By definition, exclusivity is associated with a unique know-how, a recognizable style and a creative and talented bias which can ultimately claim a higher price. In the collective unconscious, the French Haute Couture houses occupy therefore a special position, as we have already revealed in previous barometers, for China and France in particular.

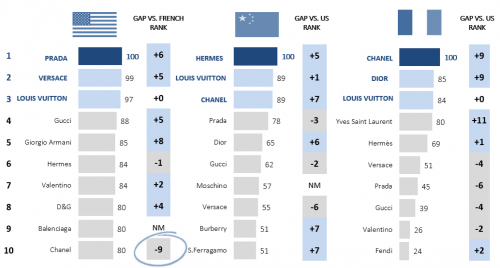

USA & EXCLUSIVITY: LOUIS VUITTON SURROUNDED BY ITALIAN DESIGNERS

The exclusivity ranking (on the right) reveals clearly that the wealthiest American clients measure and perceive exclusivity according to other criteria than the French interrogated women did in particular in 2015 during the 1st wave of the barometer Promise – Exane BNP. Highly valuating the personality of the founders, as well as the creativity and personality of the artistic directors, the Americans classify two Italian brands before France’s first luxury house Louis Vuitton and far before the two French icons, Chanel and Dior.

With its cultural patronage, sports sponsorship with the Louis Vuitton America's Cup World Series, and as newest member of the exclusive club Swiss watch houses, and through the launch of its new fragrances ... Louis Vuitton chooses a dynamic and diverse business strategy and communication, of which Uncle Sam’s country absolutely benefits. Meanwhile, Hermès, Chanel and Dior are positioned further back in the ranking.

Flat for Hermès and Chanel, two statutory brands par excellence, which yet perform better among young American consumers (25-40 years) and which occupy the 4th and 5th position with the respectively scores of 75% and 74%.

USA : A MARKET APART

If the Italian luxury brands clearly occupy the US market on exclusivity, the French luxury houses - embodied by the "Big Four", Hermés, Louis Vuitton, Chanel and Dior - remain a reference in France and China. Design, creativity, heritage, tradition, brightness, quality manufacturing, strong media coverage and the notion of “Made-in-Italy” is a huge success in the USA. Hereby we emphasize on the fact that Gucci, to a 100% owned by the French group Kering, Prada, Versace and Armani are 100% Italian brands.

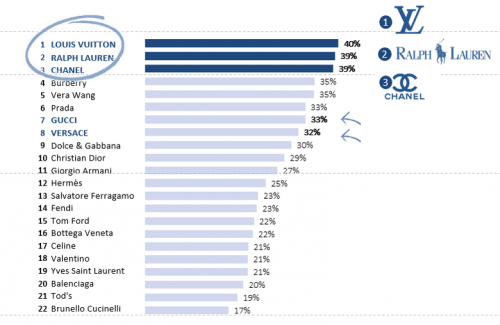

DESIRABILITY: A RANKING WHERE FRANCE CLEARLY TAKES THE LEADERSHIP

While the American wealthiest customers fall in terms of exclusivity under the spell of the Italian designers Prada or Versace, both brands sacrifice their positions in desirability. Thus, Louis Vuitton (40%) occupies the top step of the podium, closely followed by Ralph Lauren (39%) on its domestic market, and Chanel (39%), the symbol of French luxury.

Note also that Burberry rises on the 4th place (35%) due to its activeness on social networks such as Pinterest and Snapchat. Finally, Vera Wang, the New York specialist in dresses, monopolizes the 5th place (35%). On the other hand, Italian brands emerge not until the 6th position.

France, USA, UK and Italy ... Considering the American melting pot in terms of demography, the Top 10 ranking on "desirability" saw the emergence of luxury brands from these four different countries.

MORE ABOUT PROMISE CONSULTING INC.

Promise is a consulting and marketing group combining the following companies: Promise Consulting Inc., JPL Consulting and Panel On The Web. Promise integrates consulting services and surveys with a strong added value. The company has created an innovative methodology to measure the performance of brands and the ROI of investments centered on brands: Monitoring Brand Assets©. This methodology was deployed in over 35 countries to date, for 250 different brands from the most diverse sectors and has collected up to 1.000.000 online questionnaires.

Based in Paris, New York and Casablanca, the group conducts surveys and provides consulting services all over the world. Promise is more particularly acknowledged for its expertise regarding the measure of brand equity (brand value) from the consumers’ point of view. Promise has successfully developed innovative methods and models that have been rewarded 7 times in 10 years by the profession, both in France and abroad. The group is consulted for the biggest brands in luxury, cosmetics and selective distribution to help their development on the domestic and overseas markets. Promise also operates in numerous business sectors, each time the brands establish a growth strategy to better understand their market, communicate with their consumers, seduce their customers and improve their loyalty.

Promise’s CEO, Philippe Jourdan, is the chief-editor of the magazine Adetem, the French Marketing Review (RFM) since 2011. He publishes in academic international magazines on issues related to brand equity in luxury, beauty and selective distribution. He also publishes in the economic and news press (Le Monde, Les Echos, Le Figaro, l’Opinion, La Revue des Marques, etc.). Philippe is also a university professor, researcher at the IRG (CNRS) and was awarded for the best Research article AFM in 2000 and has equally a Social Media Certification. http://www.promiseconsultinginc.com/

MORE ABOUT EXANE BNP

Specialized in European shares, BNP Exane operates in three businesses:

> The intermediation in investment of European shares

> By-products shares named Exane Derivatives

> The asset management via the fund management of investment of medium and long term

BNP Exane mainly works with institutional clients all over the world (pension funds, administrators of funds for banks or for insurers, etc.) and markets its products to a vast range of customers' including administrators of private funds and investments advisers. Exane employs more than 800 people worldwide in offices in Paris, London, Frankfurt, Geneva, Madrid, Milan, New York, Stockholm and Singapore. The research teams of BNP Exane cover more than 600 big companies in the World and are regularly rewarded by Prizes for the high quality of cross-section analyses. For more information: http://www.exane.com.

CONTACT PROMISE CONSULTING

Philippe JOURDAN

Tel : +33 1 78 09 03 64

philippe.jourdan@promiseconsultinginc.com

CONTACT PRESS - AGENCE79

Dimitri HOMMEL-VIKTOROVITCH

Tel : +33 1 41 10 21 57

Mobile : +33 6 98 20 77 12

dhommel@agence79.com

Apolline GILLIOT

Tel : +33 1 46 20 59 08

Mobile : +33 6 60 92 62 28

agilliot@agence79.com